All Categories

Featured

Table of Contents

There are three sorts of annuities: repaired, variable and indexed. With a taken care of annuity, the insurance provider guarantees both the rate of return (the rate of interest price) and the payout to the capitalist. The rate of interest on a dealt with annuity can transform in time. Commonly the rate of interest is taken care of for a number of years and after that changes occasionally based upon present rates.

With a deferred set annuity, the insurance provider consents to pay you no less than a specified interest rate during the time that your account is expanding. With a prompt set annuityor when you "annuitize" your deferred annuityyou receive an established fixed quantity of cash, generally on a month-to-month basis (comparable to a pension plan).

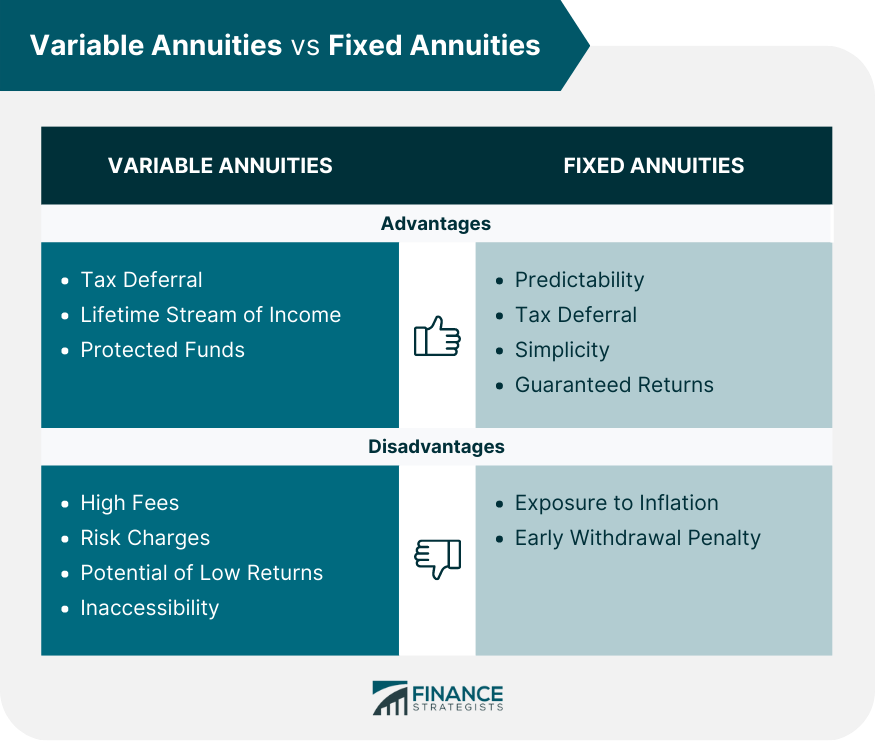

While a variable annuity has the advantage of tax-deferred growth, its annual costs are likely to be much greater than the costs of a typical common fund. And, unlike a dealt with annuity, variable annuities don't give any type of assurance that you'll make a return on your investment. Instead, there's a threat that you could actually shed cash.

Highlighting Fixed Annuity Vs Variable Annuity A Comprehensive Guide to Variable Vs Fixed Annuity What Is Annuity Fixed Vs Variable? Features of Annuity Fixed Vs Variable Why Fixed Annuity Vs Variable Annuity Is Worth Considering Deferred Annuity Vs Variable Annuity: A Complete Overview Key Differences Between Deferred Annuity Vs Variable Annuity Understanding the Rewards of Long-Term Investments Who Should Consider Fixed Annuity Or Variable Annuity? Tips for Choosing Variable Vs Fixed Annuities FAQs About Fixed Vs Variable Annuity Pros Cons Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Variable Vs Fixed Annuity

As a result of the intricacy of variable annuities, they're a leading source of financier complaints to FINRA. Before purchasing a variable annuity, carefully checked out the annuity's program, and ask the individual selling the annuity to clarify every one of the item's attributes, motorcyclists, expenses and restrictions. You should additionally know exactly how your broker is being compensated, including whether they're receiving a payment and, if so, just how much.

Indexed annuities are complex financial instruments that have attributes of both taken care of and variable annuities. Indexed annuities normally provide a minimum guaranteed rates of interest combined with a passion price connected to a market index. Lots of indexed annuities are tied to broad, popular indexes like the S&P 500 Index. Some usage other indexes, consisting of those that represent various other segments of the market.

Comprehending the attributes of an indexed annuity can be confusing. There are several indexing approaches companies use to determine gains and, as a result of the selection and intricacy of the methods used to credit rating rate of interest, it's difficult to compare one indexed annuity to one more. Indexed annuities are usually classified as one of the adhering to 2 types: EIAs supply a guaranteed minimum rate of interest (usually a minimum of 87.5 percent of the premium paid at 1 to 3 percent passion), as well as an additional rates of interest connected to the efficiency of one or even more market index.

Conservative investors who value safety and security. Those nearing retirement that want to sanctuary their properties from the volatility of the supply or bond market. With variable annuities, you can buy a range of securities consisting of stock and bond funds. Stock market performance determines the annuity's worth and the return you will certainly obtain from the cash you spend.

Comfortable with changes in the stock market and desire your investments to maintain rate with inflation over an extended period of time. Youthful and want to prepare financially for retired life by enjoying the gains in the stock or bond market over the long-term.

As you're accumulating your retirement savings, there are several ways to extend your money. can be especially helpful savings tools due to the fact that they ensure an earnings quantity for either a set amount of time or for the remainder of your life. Dealt with and variable annuities are 2 options that offer tax-deferred development on your contributionsthough they do it in various methods.

Analyzing Choosing Between Fixed Annuity And Variable Annuity A Closer Look at Fixed Vs Variable Annuity Pros And Cons Defining Fixed Annuity Or Variable Annuity Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Is Worth Considering Fixed Interest Annuity Vs Variable Investment Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Rewards of Annuities Variable Vs Fixed Who Should Consider Pros And Cons Of Fixed Annuity And Variable Annuity? Tips for Choosing Annuities Fixed Vs Variable FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

A provides a guaranteed rate of interest rate. Your agreement value will certainly enhance due to the amassing of guaranteed passion incomes, implying it won't shed value if the market experiences losses.

An includes spent in the stock exchange. Your variable annuity's investment performance will certainly impact the size of your savings. It may guarantee you'll obtain a collection of payments that start when you retire and can last the rest of your life, offered you annuitize (start taking repayments). When you begin taking annuity repayments, they will certainly depend on the annuity value during that time.

Market losses likely will lead to smaller sized payments. Any kind of passion or other gains in either kind of contract are sheltered from current-year tax; your tax responsibility will come when withdrawals begin. Let's check out the core attributes of these annuities so you can determine how one or both might fit with your overall retirement method.

A fixed annuity's value will certainly not decrease as a result of market lossesit's constant and stable. On the other hand, variable annuity worths will fluctuate with the performance of the subaccounts you choose as the markets fluctuate. Profits on your repaired annuity will extremely depend upon its contracted rate when acquired.

Alternatively, payout on a dealt with annuity bought when interest rates are low are more probable to pay out incomes at a reduced price. If the rate of interest is assured for the length of the agreement, incomes will remain continuous no matter of the marketplaces or price activity. A fixed rate does not mean that dealt with annuities are risk-free.

While you can't come down on a set rate with a variable annuity, you can select to invest in conventional or hostile funds tailored to your threat level. A lot more conventional investment choices, such as temporary mutual fund, can assist minimize volatility in your account. Because fixed annuities use a set price, reliant upon current rate of interest prices, they don't supply that exact same flexibility.

Understanding Variable Annuities Vs Fixed Annuities A Closer Look at Fixed Income Annuity Vs Variable Annuity Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Immediate Fixed Annuity Vs Variable Annuity Is a Smart Choice How to Compare Different Investment Plans: How It Works Key Differences Between Tax Benefits Of Fixed Vs Variable Annuities Understanding the Risks of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Index Annuity Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

You potentially can gain much more long term by taking added risk with a variable annuity, yet you can also lose money. While repaired annuity agreements avoid market threat, their trade-off is much less development capacity.

Spending your variable annuity in equity funds will give even more potential for gains. The fees related to variable annuities may be higher than for other annuities. Financial investment choices, survivor benefit, and optional benefit warranties that could grow your properties, also include cost. It's important to assess attributes and associated fees to make certain that you're not spending even more than you require to.

The insurance coverage company may impose surrender costs, and the internal revenue service may levy a very early withdrawal tax obligation fine. Give up charges are detailed in the agreement and can differ. They start at a particular percentage and then decline in time. As an example, the abandonment charge might be 10% in the very first year yet 9% the next.

Annuity profits go through a 10% very early withdrawal tax obligation fine if taken before you get to age 59 unless an exemption applies. This is imposed by the IRS and puts on all annuities. Both dealt with and variable annuities provide choices for annuitizing your balance and turning it into a guaranteed stream of lifetime earnings.

Breaking Down Your Investment Choices A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Features of Fixed Vs Variable Annuity Why Choosing the Right Financial Strategy Can Impact Your Future Fixed Vs Variable Annuity Pros Cons: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Rewards of Fixed Income Annuity Vs Variable Annuity Who Should Consider Fixed Index Annuity Vs Variable Annuities? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Vs Variable Annuities

You might determine to make use of both fixed and variable annuities. If you're picking one over the various other, the distinctions matter: A might be a much better alternative than a variable annuity if you have a much more conventional risk tolerance and you seek foreseeable interest and major protection. A may be a much better choice if you have a greater danger tolerance and want the potential for long-lasting market-based growth.

Annuities are contracts marketed by insurance coverage business that promise the customer a future payment in normal installations, normally monthly and frequently permanently. There are various types of annuities that are made to serve different purposes. Returns can be taken care of or variable, and payments can be prompt or postponed. A set annuity assurances payment of a collection amount for the term of the arrangement.

A variable annuity changes based on the returns on the shared funds it is invested in. An immediate annuity begins paying out as soon as the customer makes a lump-sum settlement to the insurer.

Annuities' returns can be either dealt with or variable. With a dealt with annuity, the insurance policy firm ensures the customer a specific payment at some future day.

Table of Contents

Latest Posts

Decoding How Investment Plans Work Key Insights on Your Financial Future Defining Fixed Index Annuity Vs Variable Annuities Features of Smart Investment Choices Why Choosing the Right Financial Strate

Exploring the Basics of Retirement Options Everything You Need to Know About Fixed Vs Variable Annuity Breaking Down the Basics of Variable Annuity Vs Fixed Annuity Features of Variable Annuity Vs Fix

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Investment Choices Defining Tax Benefits Of Fixed Vs Variable Annuities Pros and Cons of Annuities Variable Vs Fixed Why

More

Latest Posts